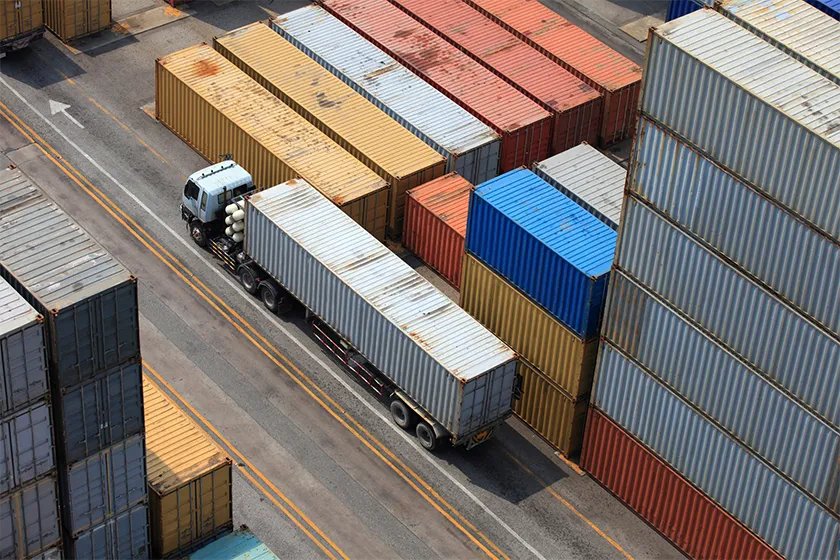

As one of Iran’s main trade gateways on the border with Turkey, Bazargan Customs plays a vital role in the country’s foreign trade. Since clearance of goods from Bazargan Customs may have its own complexities, familiarity with the legal steps and various costs of this process can help importers and exporters to clear their goods at the lowest cost and in a timely manner. In this article, we will examine the clearance steps from Bazargan Customs, the costs, and the goods imported and exported from these customs so that you can proceed with the clearance process of your goods with sufficient information and high accuracy.

As one of Iran’s main trade gateways on the border with Turkey, Bazargan Customs plays a vital role in the country’s foreign trade. Since clearance of goods from Bazargan Customs may have its own complexities, familiarity with the legal steps and various costs of this process can help importers and exporters to clear their goods at the lowest cost and in a timely manner. In this article, we will examine the clearance steps from Bazargan Customs, the costs and goods imported and exported from these customs so that you can proceed with the clearance process of your goods with sufficient information and high accuracy.

Bazargan Customs Clearance Steps

To clear goods from Bazargan Customs, it is necessary to be fully familiar with the rules and related steps so that you can clear your goods without problems or delays. Also, due to the various and strict rules for customs clearance in Bazargan, you can seek help from consultants and experts at Saina Express and proceed with the clearance process of your goods smoothly without worrying about delays or legal problems.

The main steps of customs clearance in Bazargan are fully explained below:

Registering an order and obtaining an economic code

The first step to importing goods from Bazargan Customs is to register an order through the Namad system or the Trade Development Organization of Iran. Before importing goods, you must submit your request to the customs and receive an order registration number. At this stage, you must enter complete information about the goods, their type, country of origin, and matters related to customs tariffs. You must also receive your economic code from the Iranian Tax Organization so that you can proceed with the clearance of your goods.

Paying customs duties and taxes

To clear goods from Bazargan Customs, it is also necessary to submit documents and documents including a commercial invoice, bill of lading, certificate of origin, pro forma invoice, health certificate or standard certificate, etc. to the customs, and also pay the relevant customs duties and taxes. After paying the customs duties, the goods are inspected to ensure their compliance with the documents provided and the health of the goods.

Transporting goods from customs to final destination

After the customs clearance process is complete, you can transport your goods from Bazargan Customs to the final destination.

By following these steps and preparing the required documents for clearance of goods, you can easily complete the import process without any serious problems. Also, cooperating with the experts of Saina Express Company and being aware of the latest laws and regulations can help expedite and facilitate the clearance of goods.

Imported goods from Bazargan Customs

Bazargan Customs is not only economically important for the country, but also acts as a reference for preventing violations and dealing with illegal and smuggled goods. Merchants and traders can safely clear their goods from these customs. Imported goods that are mainly imported through Bazargan Customs include the following products, which have been popular choices in recent years, considering market needs, demand and appropriate profitability:

- Spare parts

- Plastic materials

- Imports of various fabrics

- Aluminum profiles

- Types of natural stones (marble, etc.)

- Tools and engines used in industry

- Various plastic materials and products

- Types of elevator doors (automatic doors)

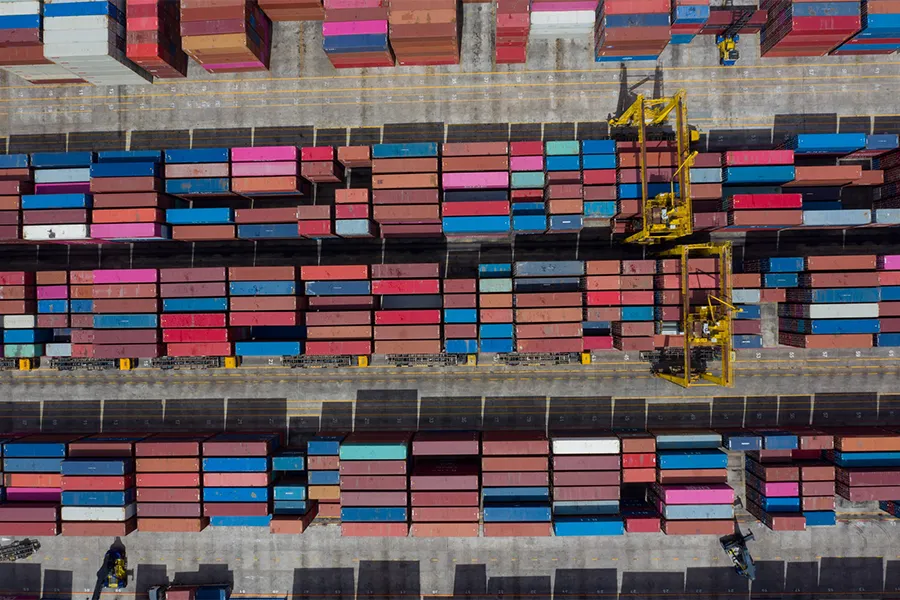

Exported goods through Bazargan Customs

Exporting goods from Bazargan Customs includes various steps, including registering and receiving an economic code, evaluating the goods, issuing a bill of lading, and completing customs formalities. Also, exporters should be aware of the customs and trade laws and regulations of Turkey and Iran in order to be able to carry out the export process effectively and without problems. Types of goods exported from Bazargan Customs usually include the following products and items:

- Mineral stones such as acusin, manganese, etc.

- Industrial raw materials such as metals, stones, minerals, and construction materials

- Handicrafts including carpet weaving, copper and bronze utensils, embroidery, traditional textiles, etc.

- Chemical and petrochemical products including chemical raw materials, plastics, chemical fertilizers, etc.

- Agricultural products such as fruits (apples, dates, grapes, saffron), vegetables, nuts, dried fruits, etc.

- Industrial and agricultural equipment and machinery, lathes, trailer parts, gearbox engines, etc.

Bazargan Customs Clearance Fees

Bazargan Customs Clearance, like other customs offices in the country, requires the payment of various fees that must be paid by the importer or owner of the goods. These fees are calculated in the Bazargan Customs Clearance process for various stages including warehousing, shipping, unloading, and other customs services. Familiarity with these fees will help you have a better understanding of the clearance process and have more accurate financial planning.

Customs Clearance Costs in Bazargan

Customs clearance in Bazargan, like other customs offices in the country, requires the payment of various fees that must be paid by the importer or owner of the goods. These fees are calculated for various stages in the Bazargan customs clearance process, including warehousing, transportation, unloading, and other customs services. Knowing these fees will help you better understand the clearance process and make more accurate financial planning.

Below, we will examine the various fees associated with Bazargan customs clearance:

Warehousing Fees

Warehousing fees are related to the length of time the goods are stored in the customs warehouse. If the goods are not cleared quickly after entering customs, the importer is required to pay additional fees for storing the goods in the customs warehouse. These fees are calculated per day or per week and may vary based on the volume and type of goods.

- Freight costs include land transportation of goods, which will depend on various factors such as distance, type of vehicle, weight of goods, etc.

- Loading costs that are considered when transferring goods from the customs warehouse to the freight vehicle for transportation to the final destination, and this cost also depends on the type of goods and their volume.

- Laboratory fees for conducting necessary health, chemical or technical tests and examinations for goods such as health goods, pharmaceuticals, food, etc. to obtain the required licenses and standards

- Customs duties for goods include customs duties, value-added tax (VAT) and other tariffs related to the import of goods, which vary based on various factors such as the type of goods, value of goods, customs tariff of the country of origin, etc.

In addition to these, you should consider other costs including special transportation services, packaging or other ancillary costs and have a detailed plan for your budget.

Conclusion

Customs clearance for a merchant has various stages, the main ones being: order registration, payment of customs duties, submission of necessary documents and transportation of goods to the final destination. Customs clearance costs also include warehousing, freight, laboratory, packaging, etc. costs, which you must consider in your financial planning. By working with experts in this field and using consulting services, you can avoid potential problems and clear your goods quickly and legally.